So often in life and in financial planning, perfect can be the enemy of good. This is certainly the case when it comes to saving for college. There are many ways to go about it, but the most important choice is the choice to begin saving. Nonetheless, we often meet parents of five- and ten-year-old children who have been too overwhelmed by the options for college savings to actually get over the hump and begin making contributions. In our first Atheneum about college planning, we will highlight the different vehicles for college savings that a family can use to drive down the road to a degree.

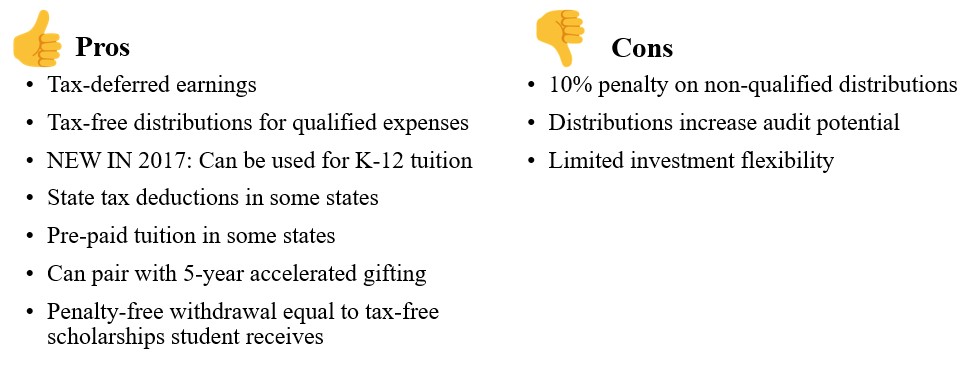

529 Plans: One Size Fits Most

Section 529 was added to the IRS code in 1996 and has seen saver-friendly improvements ever since, including in the Tax Cuts and Jobs Act of 2017. This plan achieves what most families desire: some tax advantages for the savings they are making specifically for college. Funds are invested and grow tax-deferred and are distributed tax-free for educational expenses. To get this tax treatment, the funds give up some flexibility in that they must be used for qualified educational expenses. There are many qualified expenses on top of tuition, including off campus housing up to the school’s published room-and-board. Nonetheless, it is best to fund 529s only to the extent that you are reasonably sure the child will be spending dollars on education.

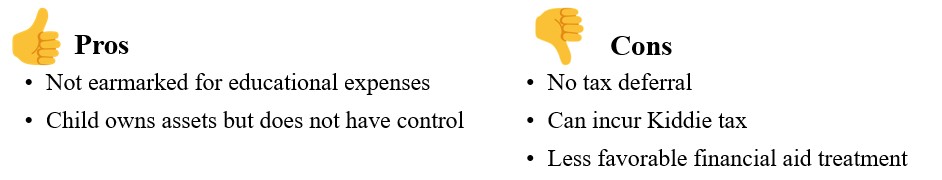

UTMA: When College is Optional

We are seeing more students each year, even top-flight scholars, decline to matriculate straight from high school to a four-year university. Many parents we speak with would rather see their child gain some work experience that might help define career aspirations rather than begin courses with an undefined goal. Such a family may prefer to save in a Uniform Transfer to Minors Act (UTMA) account. UTMA accounts are custodial investment accounts that are transferred to the child’s ownership at the “age of termination,” which is 18 in Kentucky and 18 or 21 in most states. If you have a responsible child who may start a business or defer college, a UTMA may be a good savings tool.

Roth IRA: Trendy Recommendation, Retirement Drag

If you search Roth IRA for college, you will find many opinions proclaiming the Roth IRA as the #1 college savings tool. This is because qualified educational expenses avoid the 10% early withdrawal penalty that is generally standard for IRA distributions before age 59 ½. The thought process goes, in case my child doesn’t go to college, I will have Roth IRA dollars ready for my retirement – no tax, no penalties! We don’t use this as a go-to recommendation, because most families we know who can afford to save for college should be doing BOTH. We like Roth money for its long-term tax benefit. Any one Roth IRA dollar mentally earmarked for college is perhaps three tax-free retirement dollars forgone. Behaviorally, we would rather see parents max out retirement savings for themselves AND use a separate vehicle to save for college. If worried about the child not attending college, we like UTMA or taxable savings.

Taxable Savings: Keeping it Simple

In discussing UTMA above, we mentioned a responsible child. In practice, that is very difficult to ascertain when we are mapping out college funding. Is two-year-old Little Johnny who jumps all over grandmom’s couch merely energetic, or are we raising the next Evel Knievel? As financial planners, we do our very best to avoid answering such a question! Joking aside, many parents of young children do not like the idea of an 18-year-old controlling their investment account. Some are worried about responsibility, and others want their children to earn ownership through some defined milestone. In this case, a taxable account is a great option to expose savings to markets, under the parents’ ownership, without making any irrevocable decisions.

Cash Flowing College: A Hidden Option

A rarely discussed college funding option is paying with the almighty dollar when the time comes. Many families with young children are also building businesses, paying off homes, and caring for elders. With so many places that demand money, college savings often falls to the end of the priority list. We have planned with several families to eliminate expenses coinciding with a child’s college career. Can we pay off that 15-year mortgage and then use those dollars to help Suzy pay her tuition bill? This is often painless and as an added benefit, direct tuition payments are not considered taxable gifts. This works great for both parents and grandparents who may come into some extra cash flow when a child or grandchild is entering college.