One of the more arduous tasks facing retirees and soon-to-be retirees is trying to determine how much money can be withdrawn from retirement accounts each year without running out – yet not skimping yourself either. Solving this puzzle has become even more challenging given today’s low interest rate environment and tempered expectations for future investment returns, not to mention that on average people are sticking around for a few more years. The old adage suggests you withdraw 4 percent each year from a diversified portfolio of stocks and bonds, adjust annually for inflation, and you should have enough to last 30 years in retirement. Unfortunately, like most rules of thumb, this one has issues.

First off, the 4% rule was founded in the early 90’s when interest rates were significantly higher and equity valuations (as measured by price earnings ratios) were relatively lower. A study on the Social Science Research Network entitled, “The 4 Percent Rule is Not Safe in a Low-Yield World” concludes that in today’s low-yield environment the risk of failure for a 4 percent withdrawal rate may be upwards of 50% if rates stay this low indefinitely¹.

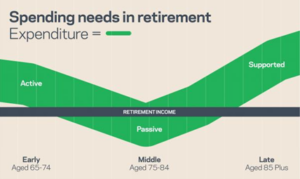

Another problem with blindly withdrawing a fixed percentage from your retirement savings each year is that spending can change greatly depending on what stage of retirement you are in. If we think of retirement in three stages (early, middle and late), the spending pattern tends to be V-shaped, like the image below². What may be sufficient income in the early stage of retirement may not be needed in the middle stage, or what may be sufficient in the middle stage may not be enough in the late stage.

The fact is there is no magic formula or crystal ball that will give us the exact withdrawal rate in advance. There are simply too many uncertainties like investment returns, inflation rates, how long you live, and what your spending turns out to be in retirement. So instead of focusing on an exact percentage or dollar amount we should start with a few other considerations:

- The early stage of retirement may require a similar level of income as your working years – many of the activities that fill the void of not working cost money, like traveling and spoiling grandkids. Not to mention the new expenses of health insurance and unreimbursed medical costs. In addition, more and more people are heading into retirement with mortgages.

- Start with something reasonable and remain flexible – given the uncertainty of investment returns and your actual spending need in retirement, it is important to start with a sensible withdrawal rate and make adjustments as you go. For example, if we experience a big market correction, it may be prudent to minimize the amount you withdraw over the next few years in order to give your investments a chance to recover.

- Use a “Monte Carlo Simulation” – this important tool provides clear data on the likelihood of success for retirees given changes in spending levels, return expectations, and a multitude of other factors. From these simulations we are able to create an action plan – some may decide to keep working in retirement while others may decide to simply cut back on spending.

Figuring out how much you can spend in retirement is a moving target and everyone has a different view of retirement and spending. Simply setting a withdrawal rate and not making adjustments along the way is probably not wise for most retirees. Retirement planning is a very personalized matter and should be handled on an individualized basis, not a one size fits all approach.

¹Michael Finke, Wade Pfau and David Blanchett. 2013. “The 4% Rule is Not Safe in a Low-Yield World.” Journal of Financial Planning.

²https://www.cffc.org.nz/retirement/the-three-stages-of-retirement/