Key Takeaways:

- Diversification can be overdone – there is a point where adding another investment to your portfolio can be harmful to the risk/return profile

- The goal of portfolio diversification is to reduce volatility – owning assets that don’t always move in sync with one another.

- Naively attempting to diversify your portfolio by investing in every sector may cause more harm than good.

Conventional wisdom tells us that investing all our money into any one asset type carries an inordinate amount of risk, but is it possible to spread our investments over too many asset types? The term diworsification was coined by Peter Lynch in his 1989 book, “One Up On Wall Street”. He used the term to lament that some companies expand into areas widely different from their core business, ultimately to their detriment.

Although he used the term to describe a company-specific problem, diworsification has evolved into a concept that describes the fallacy of adding too many asset classes with similar correlations to a portfolio, negatively impacting risk and return.

Most investors think they are well diversified because they own several different asset classes and securities. In reality, they own a group of highly correlated assets that act very similarly to one another. Just because you own several different funds or EFTs doesn’t mean you have a truly diversified portfolio. It is important to understand how all of the individual securities in your portfolio are correlated and how each tends to perform under certain circumstances. Take, for example, a portfolio of 20 growth stocks during the first part of this year when high beta names got pummeled.

You may have felt diversified because you owned 20 different companies, but did these stocks act differently enough from one another to provide any real reduction in volatility? The answer is most likely, NO.

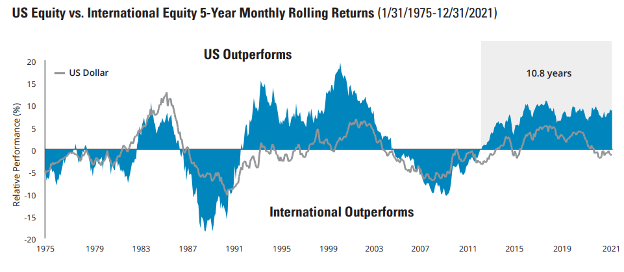

Remember, the biggest benefit of being well-diversified is volatility reduction. The goal is to own assets that don’t move in sync with one another, when one of our holdings is going down, we should have others that are moving higher, making for a smoother ride over time. Over the last several years one of the most often asked questions has been, “Why do we own international stocks in our portfolio when U.S. stocks have performed so much better?” The simple answer is for the diversification benefits. We want to have exposure to many areas of the global economy while also avoiding single-country risks such as tax, politics, currency, and trade policy.

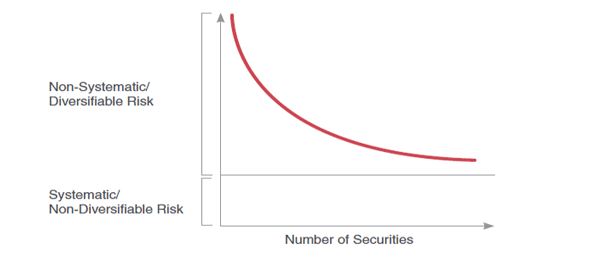

While the benefits of being properly diversified cannot be denied, there is a point where the cost of adding another investment to your portfolio can exceed its marginal benefit. This is the second part of diworsification, which is being over-diversified. It is easy for investors to mistake quantity for diversification, meaning we become irrationally confident that we’re properly diversified because we own many investments.

Remember, the more investments you add to your portfolio do not necessarily equate to greater diversification. When investing in too many asset classes with high correlations, we create an averaging effect that is detrimental to the risk/return profile.

When making asset allocation decisions we’ve all heard the time-tested analogy: “don’t put all your eggs in one basket”. We all agree that spreading your investments across different asset classes reduces the risk that a single security will adversely affect the performance of your portfolio. However, naively diversifying your portfolio to have exposure to every sector may cause more harm than good.