- Fewer than 15% of taxpayers itemize deductions since 2018 tax reform.

- Timing the donations you already plan to make can maximize tax deductions.

- Your charities can still receive stable monthly income via a Donor Advised Fund.

This week marks the first official week of summer and, at least for my family, this change of season is mirroring the rejuvenation typical of spring. After a year plus of social restrictions, it seems like everyone is excited to reengage. Alongside the barbecue & birthday invites, we’ve seen a resurgence of events centered around our favorite charities. Many nonprofits had a tough year as they lost the opportunity to gather supporters and raise funds, while also experiencing increased demand for their services. As you RSVP to summer galas, we want to review a charitable giving strategy that can enhance your contributions to your closest causes.

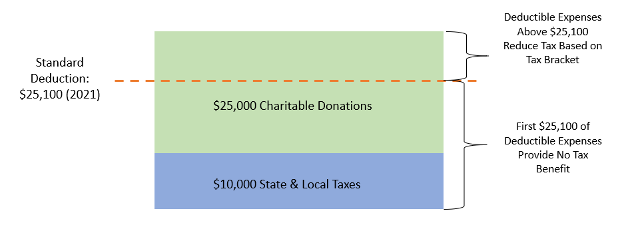

Are you receiving a tax benefit for every dollar you donate to charity? Since 2018, the odds say you are not. The Tax Cuts & Jobs Act doubled the standard deduction and limited deductible state & local taxes to $10,000. Before that reform, about 30% of taxpayers itemized deductions; tax experts now estimate that less than 15% itemize. For families with no mortgage and minimal healthcare expenses, it’s likely that the first $14,000 of charitable donations in any given year provide no tax benefit (compared to taking the standard deduction). Imagine a family that donates $25,000/year. They may only see a reduction in the tax bill from the last $9,000 they donate.

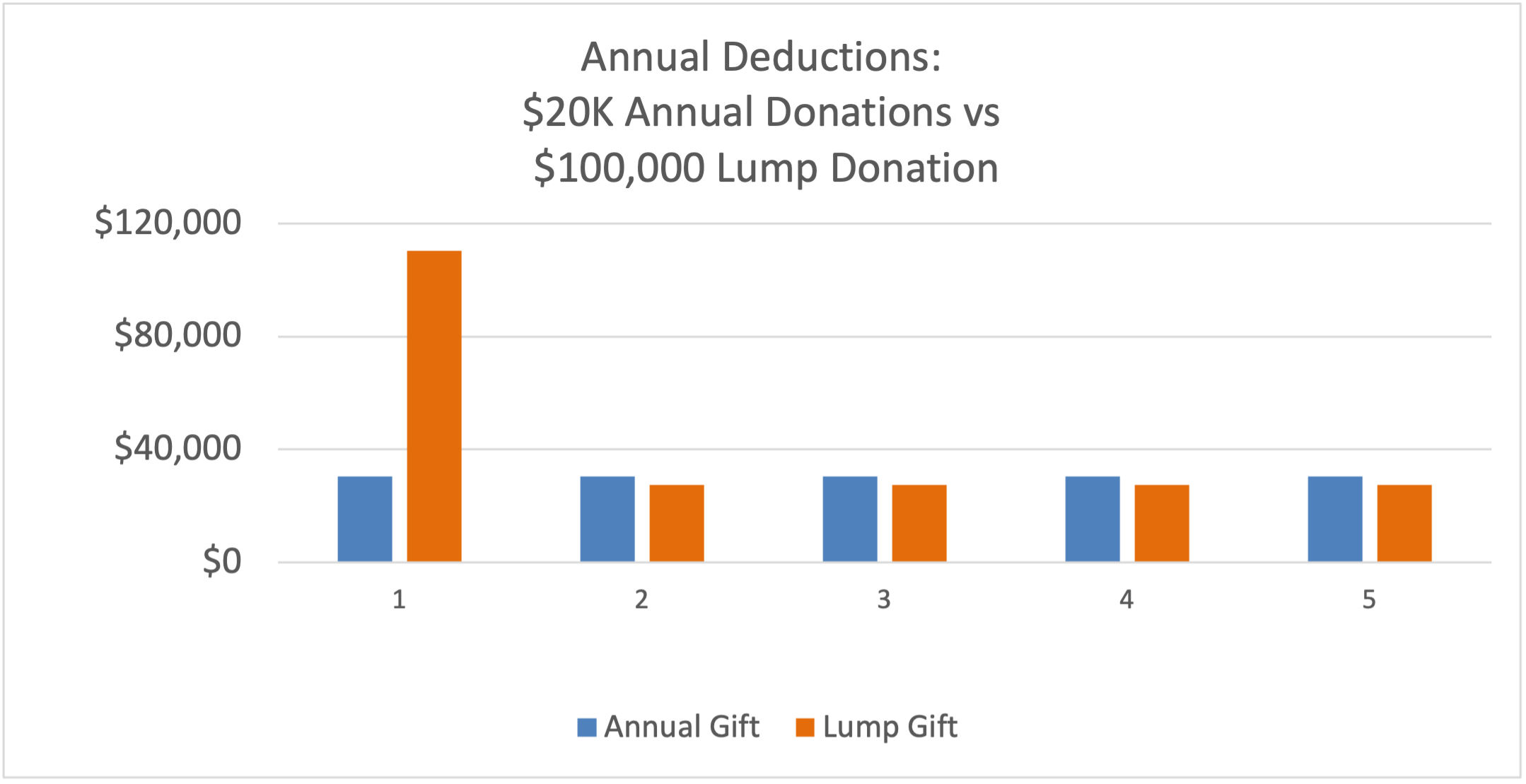

Luckily, we do have a solution for our many clients who we believe fall into the category of non-itemizers. If we don’t benefit from giving small donations in any one tax year, it makes sense to donate a larger amount that can benefit charities over a number of years. In the example below, we suggested to a client who donates $20,000/year to instead make one $100,000 donation every five years. The result is they deduct about 70% more of their charitable donations and save over $20,000 in tax over the five year period.

We also enjoy pairing this strategy with a Donor Advised Fund, which allows the donor to make write the big check once and then direct those funds to charities over time just as before. Nonprofits tell us they love this strategy because it keeps their budgets stable. Donors love it for a couple psychological reasons. When they are approached for a cash donation, they can say they make donations from their charitable fund, which gives them time to read up on the organization and make an informed decision. Then when it comes time to make a donation, they know they have already donated the funds; they are merely allocating them to a chosen charity. This reduces the feeling that giving is a tradeoff, similar to the benefit we see of enjoying your vacation more when all the expenses have been prepaid.

Other Summer Charitable Giving Quick Notes

- Kentucky is one of five states with a tax incentive for donations to endowments (IA, KY, MD, MT, ND). The Endow KY tax credit is 20% on up to $50,000. Applications are due July 1; contact us immediately if you are interested.

- Appreciated stock is always a better donation tax-wise than cash. The S&P 500 is up over 60% from the March 2020 trough. We love to be consulted on donations of stock.

- Non-itemizers were able to deduct $300 “above-the-line” thanks to the CARES Act in 2020. For 2021, joint filers can deduct $300 each. If you are out of the habit of saving proof of donations, do so for at least $600 for 2021.

- If you are taking Required Minimum Distributions and not itemizing deductions, it’s likely that you could save tax by donating directly from your IRA via a Qualified Charitable Distribution. Please contact us if you believe this applies to you.