When it comes to retirement planning, one of the most often asked questions is, “What’s my number?” In other words, how much money do I need to save to retire comfortably? Simple, right? Well, not exactly — it’s far more than just a static number posted on our refrigerators. Although there are quick formulas and calculators available to help you get a ballpark number, the fact is there is no magic formula that fits every person.

Take for example a very basic case of someone who is ten years out from retirement — think about how many assumptions must be made to get to their “number”. Let’s say this person is 55 years old, plans to retire at 65, live to be 95, and goes by Elaine Denes. We need to make projections on the following: income and expenses while still working, retirement plan contributions, retirement income needs and living expenses, income streams during retirement, rate of return on investments pre and post retirement (including inflation assumptions), tax rates over the next 40 years, and many more. Bottom line — we are going to make a significant number of assumptions to project Elaine’s retirement picture, and simple one size fits all calculators aren’t nearly precise enough.

The good news is once we’ve determined these different figures, we have a tool that provides us a much more clear and precise picture. This technique used to calculate the percentage probability of specific scenarios that are based upon a set group of assumptions and standard deviations, is known as the Monte Carlo Simulation. Simply put, it is a method of testing an outcome over a range of possible variables.

Below is an example of how we use Monte Carlo Simulation to help clients understand the probability of achieving their version of “financial success” in retirement. Let’s go back to Elaine’s case and make the following static assumptions:

- Ten more working years until retirement with $100k annual income

- $750k in 401k – contributing 10% annually until retirement

- $150k in savings with no further contributions

- $100k in Roth IRA – contributing $6,500 annually until retirement

- Paid off house – market value of $250k

- Will file for Social Security at age 65 with first year benefit of $26,411

- Primary goal – fund living expenses throughout retirement

Now let’s look at four different scenarios, each with at least one variation from the base case:

- Base case (recommended scenario) – retirement income need of $75k with a real return (net of inflation) of 5% before and during retirement.

- Retirement income need of $75k with a real return of 3% before and during retirement.

- Retirement income need of $85k with a real return of 5% before and during retirement.

- Retirement income need of $85k with a real return of 5% before and during retirement and a 50% cut to Social Security income.

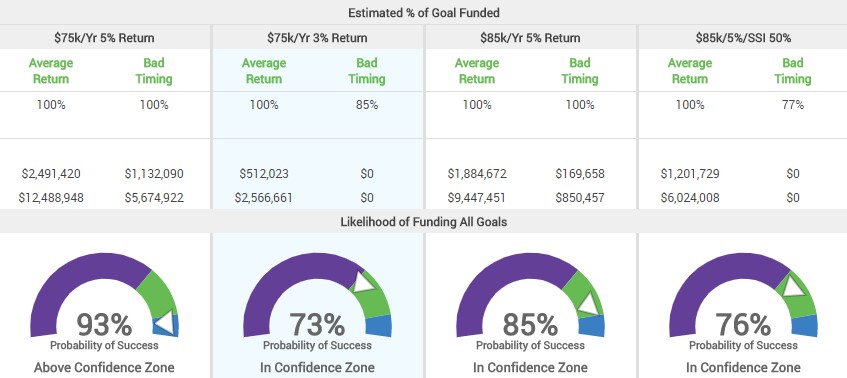

Using Monte Carlo Simulation to run thousands of trials, each time using a different sequence of returns, we get the following results:

Elaine has a 93% probability of success if she spends $75k/year in retirement and earns a 5% real return on her investments. In Scenario 2, we keep her annual spending at $75k but deflate her average annual return by 2%, which results in her probability of success dropping to 73%. In Scenario 3, we up Elaine’s spending to $85k/year while boosting her annual return to 5%, giving her an 85% probability of success. We keep those two variables static in Scenario 4 but decrease her Social Security income by 50%, resulting in a 76% probability of success. Based on this information, Elaine will have a much better understanding of how much she needs to save, how her investments should be allocated, and how important her spending patterns will be both before and during retirement to allow her nest egg to last a lifetime.

Obviously, we cannot predict the future and we do not know the exact path Elaine’s financial future will go through. However, by creating, updating, and monitoring a Monte Carlo simulation, we can make more informed decisions about how to invest her money, how much money she can withdraw responsibly, how much cash to maintain, etc. Without doing these types of analyses and without continually monitoring them, a soon-to-be retiree or retiree may be going down a blind path, rather than following a pre-defined and measured trail with some uncertainties.

If we have not updated your Monte Carlo simulation recently, please let us know so that we can review your financial roadmap this year. If there are any family, friends, or colleagues who you believe could benefit from this type of analysis, please do not hesitate to contact our office. We are happy to help!