If you feel like the stock market has been all over the place recently, there is some merit behind the feeling. So far, during 2022 we have experienced 41 days where the S&P 500 has returned greater than a +/- 1% return. This represents approximately half of the trading days of the year so far and may soon surpass the 55 trading days recorded in 2021.

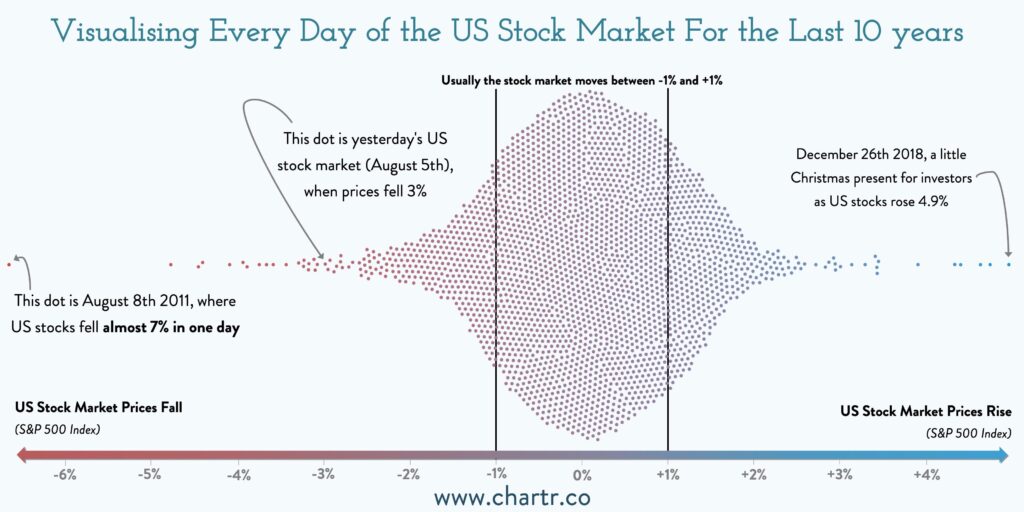

To add context to how frequent these market days are, the below chart visually demonstrates daily returns in the stock market. It is safe to say that volatility has returned to the equity markets. On the chart below, greater than 1% of swing trading days are shown outside of the vertical lines.

Previous commentaries have discussed the fundamentals of what is causing the market to react with such momentum – namely inflation, interest rates, and geopolitical events – and their potential impacts on a generally strong underlying economy. Additionally, valuations are starting to matter again, with many speculative growth stocks seeing significant losses on the backend of unsustainable (unwarranted?) stock price growth. This is a long-term positive for disciplined investors.

How consumers, businesses, and investors will respond as the Fed raises rates is up for debate; however, it is fair to say that the market is telling us that there is uncertainty on the backend of a rate increase. The largest looming question is whether the Federal Reserve can tamp down inflation and generally slow a robust economy without bringing it to a screeching halt.

So what can we do about this as investors? Let’s discuss our principles.

- Seek out opportunities to buy low and sell high. We are continually looking for investments/sectors that are undervalued. These are generally added to our portfolios by rebalancing in periods of market volatility or by adding new investments we believe represent opportunities with sustainable economic trends.

- Review liquidity needs. Do you have liquidity through cash or bonds for a period of sustained market volatility and/or correction? Through our planning process, we try to focus significantly on this question.

- Control what can be controlled. Nobody should make investment decisions based on conjecture or speculation – the market is going to surprise many people at any given time. However, through appropriate asset allocation, sound investing principles, and high-level financial planning, we can increase our probability of meeting our goals based on fundamental planning, rather than market speculation.

- Stay the course and remain unemotional/disciplined. Anyone who owns equities should be a long-term investor with at least that portion of their portfolio. There will be periods of market volatility and economic uncertainty; however, we must not overreact to short-term disruptions that have less material impact over the long term.

As always, we are here to help. If you have questions about your plan, your portfolio, or the market/economy, please do not hesitate to reach out to us. Now is as good of a time as ever to review your plan.