Key Takeaways:

- Publicly traded companies will be releasing earnings reports over the next several weeks.

- Economists believe growth so far coupled with forecasted growth for the remainder of the year will result in great GDP growth.

- Consumers are still holding abnormally large amounts of cash savings, setting the stage for a large return of consumer spending as businesses reopen.

It’s earnings season again – these several weeks that come four times per year at the end of each quarter when publicly traded companies report to their shareholders. Taken as a whole, quarterly reports can give a pretty good indication of the direction of the overall economy.

If you tune in to financial news during earnings season, it’s very likely that the majority of what you’ll hear and read about is directly related to quarterly earnings. However, there are some other economic reports set to be released that are worth noting. Throughout this week, data will be released on housing starts, existing home sales, initial jobless claims, and manufacturing and services PMI.

As we, our country, and the world continue to reemerge from nearly a year of pandemic lockdowns, economic data is showing positive signs of growth. Looking back to the first three months of the year, the U.S. economy grew at a rate of 6.4% guiding some economists to believe 2021 may be the strongest year for the U.S. economy in seventy years.

Lead U.S. economist for Oxford Economics, Lydia Boussour optimistically forecast that this most recent Q2 GDP growth would increase to an annual rate of 12% and that actual growth for all of 2021 would clock in at 7.5%. That would be the best performance since 1951. Even less optimistic economists who forecast 2021 growth between 6% and 7% believe that the annual growth this year will be the greatest in nearly forty years when the U.S. economy grew at a rate of 7.2% in 1984.

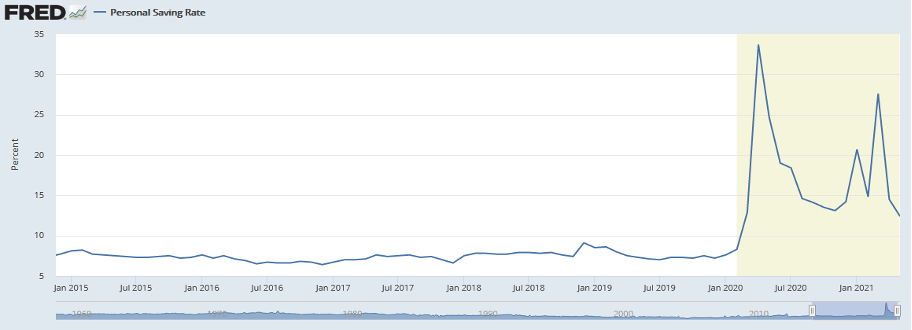

Personal Saving Rate, January 2015 – Current; U.S. Bureau of Economic Analysis

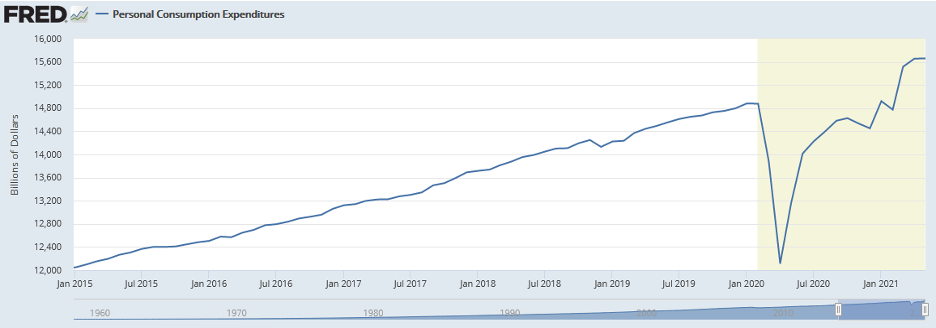

Consumer spending, which accounts for roughly two-thirds of economic activity, grew at a massive annual rate of 11.4% in the first quarter of 2021. Granted at least some of that spending may have been spurred on by multiple rounds of stimulus checks sent by Congress. However, the data shows that many consumers are still holding abnormally large cash savings which provide the opportunity for increased consumer spending as more and more businesses reopen.

Personal Consumption Expenditures, January 2015 – Current; U.S. Bureau of Economic Analysis

While there is still about half of the year to go, many sets of data are pointing to our economy making a strong recovery. Economists looking at many of these data believe that the expected growth this quarter will result in a GDP output that will top the previous peak at the end of 2019 when we were still living in the longest economic expansion in our country’s history.

SOURCES:

Domm, Patti; Earnings could be the biggest driver for markets in the week ahead as investors watch bonds; CNBC; July 16, 2021; https://www.cnbc.com/2021/07/16/earnings-could-be-the-biggest-driver-for-markets-in-the-week-ahead-as-investors-watch-bonds.html

Crutsinger, Martin; US economy grows 6.4% in Q1, and it’s likely just the start; AP; June 24, 2021; https://apnews.com/article/consumer-spending-gross-domestic-product-economy-business-ea9f24b146848b0821b549abb6cf78c8

St. Louis Fed; Personal Savings Rate; U.S. Bureau of Economic Analysis; https://fred.stlouisfed.org/series/PSAVERT

St. Louis Fed; Personal Consumption Expenditures; U.S. Bureau of Economic Analysis; https://fred.stlouisfed.org/series/PCE