When I first started writing this article, my introductory sentence was “Social Security on the surface is a very simple concept.” However, as I began to write about all of the “simple” information, I have to conclude that Social Security is not very simple at all if you are not continually dealing with it. Below, I will try to lay out the “simple” aspects of Social Security.

In the following Atheneum articles, we will selectively detail more of the complex planning that we must consider when advising clients on when and how to take Social Security income. Please note that this entire commentary solely focuses on “Old Age” Social Security benefits (retirement). We are not focusing in this article on the Survivors and Disability Insurance Program aspects.

To begin, as a person earns income, part of their W-2 income is taxed at a rate of 6.2% to the employee and 6.2% to the employer. In 2022, income is taxed until wages equal $147,000, at which point the employee is “fully paid in” for the calendar year. Once a person reaches age 62, they are eligible for benefits based upon the amount of income that they were taxed on during their working years. To be eligible for these retirement benefits, a worker must have accumulated at least 40 quarters (10 years) of earned income, earning at least $1,510 per quarter, in today’s dollars.

If a person qualifies for retirement benefits, the Social Security Administration will provide a statement projecting three different retirement periods; Full Retirement (age 66-67 depending on the year of birth), earliest eligible age (age 62), and the age at which benefits no longer accrue higher (age 70).

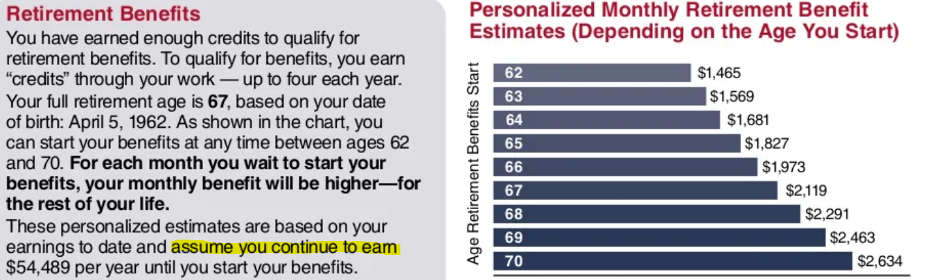

Below is an example of part of a Social Security statement, which demonstrates these projections. NOTE: the last sentence… “based on your earnings to date and assume you continue to earn” the same amount.

This projection will use a formula if you continue working at a similar earnings rate until the age at which you take the benefits. If you stop working earlier than this time period but delay taking Social Security income, this would likely reduce the actual income received relative to the projection.

Source: SSA website

If you are in a situation where you plan to be retired for a period before taking Social Security, the SSA.gov website has a great resource to provide a better projection. The calculator, located here, provides the ability to input prior years’ income figures while allowing the individual to assume a certain amount of income per year until the person decides to take Social Security. If one plans to retire at 62 but not take Social Security until 70, one can put a $0 income number for future years. This would provide a more accurate projection as compared to the statement projection shown above.

Many ask how the Social Security Full Retirement Age benefit is calculated.

The Full Retirement Age Social Security benefit is called the Primary Insurance Amount (PIA). The PIA is the amount at which retirement benefits are neither reduced nor increased for changing the date at which Social Security begins (more on this later).

The PIA calculation is the sum of three separate percentages of portions of their HIGHEST average monthly earnings based on up to 35 years of earnings. The PIA calculation is rather complex, if you want to read more to better understand the calculation, here is a good source.

The important takeaway is that Social Security is projected based on the highest 35 years of income. Therefore, if one is using the projection from their statement but plans to retire earlier, the assumption may over-inflate the benefit. This happens because it may likely assume that the later, higher income years will replace earlier, lower income years.

The age at which a person takes Social Security income is important and should be considered within the parameters of a person’s overall financial plan. However, the basics are just as important to understand.

If a person decides to take Social Security income before their Full Retirement Age (66-67) then their benefit will be reduced by 5/9 of one percent for each month before the normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced by 5/12 of one percent per month.

However, if a person takes their benefit after Full Retirement Age, then the benefits will increase by 8% per year, as well. It is important to note that once a person reaches age 70, this 8% accrual no longer applies. Therefore, there is no reason, that we are aware of, to ever delay Social Security benefits past age 70.

Keep in mind, that if a person takes Social Security before the Full Retirement age, there is a limit to how much income a person can earn without Social Security benefits being reduced.

In 2022, if you are younger than Full Retirement Age and receive Social Security income, you can earn $19,560 without penalty. However, for every dollar that you earn above this amount, $1 will be deducted from benefits for each $2 that is earned. Note, this is EARNED income – retirement income, such as IRA withdrawals and pension income, does not count toward this figure.

One interesting concept to know is that the Social Security Administration will allow a person to request retroactive payments. To be eligible for retroactive payments, the person must be past Full Retirement Age and may only request up to six months of retroactive payments. Note that if a person requests this, they will be electing an earlier age for Social Security payment to be effective.

While this article is lengthy, we have only scratched the surface of Social Security. There are so many different nuances that may affect a particular person’s situation. We always encourage people to involve us in the Social Security decision and to start the conversation early. Social Security is a very important aspect of one’s retirement situation and getting it correct is essential.