Key Takeaways:

- You could be facing up to a 30% reduction in your PIA by taking Social Security retirement benefits at age 62.

- By waiting until age 70, your retirement benefits will be roughly 32% higher than your PIA.

- The breakeven for taking Social Security retirement benefits at age 70 compared to age 66 is roughly 13 years.

There is a debate over when a person should begin to take their Social Security retirement income benefits. On one side, proponents might argue that you should take your Social Security benefits as early as you can, while the other side argues that you should wait until age 70.

An important phrase to remember when talking about Social Security retirement benefits is “Full Retirement Age,” or FRA. Your FRA is determined by your birth year, and it is the age at which you can take 100% of your Social Security retirement benefits. This amount is called your “Primary Insurance Amount,” or PIA. For those born between 1943 and 1954, FRA is age 66. For those born in 1955 and later, FRA begins to increase by two months at a time up to age 67.

In general, if you are eligible for Social Security retirement benefits, you can start taking your benefits before your FRA at age 62, but that comes with a price (see chart below).

ASSUMPTIONS: Born between 1943 and 1954; FRA is 66; PIA is $1,000/month |

|||

Age to Start Taking Benefits |

Amount of Monthly Benefit |

Amount of Annual Benefit |

% Difference from PIA |

| 62 | $750 | $9,000 | -25% |

| 63 | $800 | $9,600 | -20% |

| 64 | $867 | $10,404 | -13.30% |

| 65 |

$933 |

$11,196 | -6.70% |

| 66 | $1,000 | $12,000 | Even (this is the PIA) |

| 67 | $1,080 | $12,960 | +8% |

| 68 | $1,160 | $13,920 | +16% |

| 69 | $1,240 | $14,880 | +24% |

| 70 | $1,320 | $15,840 | +32% |

Every situation is different and should be analyzed in its own context, but when it comes to Social Security retirement benefits, most of the time we would recommend waiting until at least FRA, and potentially longer. Each year beyond your FRA, your benefits increase by 8%. Once you reach age 70, your benefits no longer increase.

Mathematically, we can calculate that your benefit at age 70 will be roughly 32% greater than at age 66. We can also calculate your breakeven – essentially if you wait four more years to take your benefits at age 70, how long would you have to live to make the wait economically worth it? The answer to that question is about 13 years. By age 82, your cumulative benefits received by waiting until age 70 will have surpassed your cumulative benefits had you begun receiving them at age 66. For those who are curious, the breakeven for taking your benefits at age 67 is age 79; at age 68 is age 80, and at age 69 is age 81.

This is all well and good on paper, but how long will you live?

Someone reading this article may live to age 100+ (that person might greatly benefit by waiting until age 70), but the reality is that we don’t know when our time will come. In that case, you could make the argument that you’ve paid into Social Security your whole working life, so it’s time to collect your benefit now while you are alive and able. That is not a bad argument, but if you are financially able, we might suggest holding off a few more years.

Among the perks of Social Security retirement benefits are that they are a “fixed” source of income. The greater your fixed income in retirement, the less you must worry about market fluctuations in your investment portfolio. If the market is down X%, but you still need $Y to live on, having a higher fixed Social Security retirement benefit coming in the door will make the down markets more tolerable.

To help illustrate this point, let’s consider the example of the hypothetical retiree, Sam.

Born in 1957, Sam plans to retire this year at age 65. For retirement, Sam has accumulated $1,500,000 consisting of a $1.25 million 401(k) and a $250,000 taxable investment account with $200,000 basis. Sam needs $84,000 per year after tax ($7,000 per month) in retirement. Sam is now faced with the decision of whether to start taking Social Security at 66 and 6 months (FRA) or delay benefits to age 70.

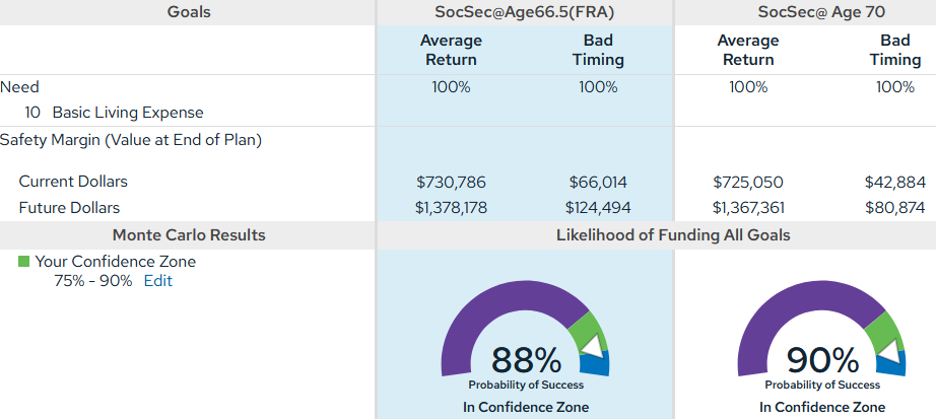

Using our Monte Carlo simulation software, we can input these variables and by isolating the age at which Sam begins taking Social Security benefits, give a statistically based answer to the question of whether to delay. At age 66 and 6 months, Sam would be looking at an annual benefit of $39,913 ($3,326 per month). By waiting until age 70, Sam would have an annual benefit of $51,089 ($4,257 per month). All other variables equal, this difference of nearly $1,000 per month (pre-tax) moves the probability of success (i.e., not running out of money) in Sam’s Monte Carlo simulation from 88% to 90%.

There are many factors at play when deciding when to take Social Security retirement benefits including portfolio makeup and size, market performance, the presence or absence of a pension or annuity, or an unexpected financial hardship to name a few. One major advantage of the Monte Carlo simulation that we do not have in the real world is that we must input a “planning age” – which is a nice way to say the age at which a person will die. Since we don’t know that answer for anyone in real life, it makes this Social Security timing decision less of an exact science. However, if your portfolio assets can bridge the gap to age 70, the math would say your plan might have a greater chance of success if you wait.

More:

Sources:

- Social Security Administration; Can You Take Your Benefits Before Full Retirement Age? Benefits Planner: Retirement; Accessed July 22, 2019. https://www.ssa.gov/planners/retire/applying2.html