Parents of college-bound students are dealing with a chicken-or-egg dilemma. When it comes to student aid calculations, it just about requires a Ph.D. to understand how to fund a Ph.D. Different schools use different methods to evaluate different families, and when they get the results, they interpret them differently! Let’s wade into the wishy-washy world of student aid to search for some understanding and best practices for parents and students.

First, a note for today’s “lawnmower parents,” so dubbed due to their tendency to mow down any obstacle in their student’s path: it is best not to over-plan when it comes to financial aid. Need-based financial aid is only regularly available for students who live in households with income below $50,000. There exists a cottage industry built to shield assets from college financial aid offices, sometimes using extreme methods that can hurt the family financially. Instead, we suggest a realistic understanding of the financial framework and measured action.

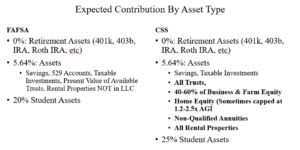

It’s not useful today to compare the sticker price of two schools. Instead, families need to compare based on Expected Family Contribution (EFC), which is the amount a particular school expects the family to contribute based on income, assets, and number of students in the household. This must be individualized because schools ask different questions and apply different valuations to come to a final EFC. Most public schools rely on the Free Application for Federal Student Aid (FAFSA). Many private schools use the College Board’s CSS Profile.

Clearly, the CSS profile is more comprehensive and that leads to some best practices. Certain students will fare far worse with the CSS profile and should include some schools relying on the FAFSA in their search. If the household has most of its net worth in the family business or farm, this is true. The same goes for students who live with the lower-earning parent after a divorce*.

The second difference to note is the treatment of gifts the household receives, which are counted as income on the CSS. Parents are expected to contribute 47% of net income toward college. This means a gift to a freshman or their parents can scuttle their chances of aid in subsequent years. This can include distributions from grandparent-owned 529 accounts and direct payments of tuition. If the student is receiving need-based financial aid, gifts are best delayed until after their final aid package. If the student has no need-based aid to lose, we suggest direct payment to the school for anything over the IRS gift exclusion** to avoid gift tax. Direct payment of tuition to institutions is not considered a gift, which represents massive estate reduction potential for households potentially subject to estate tax reform.

Assets are also treated differently on the FAFSA and the multiple methods of using the CSS. Parental retirement assets are excluded, which is a welcome surprise to our clients who aggressively fund retirement accounts. Rental properties in name are penalized on the FAFSA; this is another reason why investment real estate should be separated legally. In both cases, student assets receive worse treatment than parental assets. However, in most cases we see where the student has substantial assets, the parent’s income precludes them from financial aid. A future commentary will argue for assets in the student’s name for tax purposes.

Once the family completes their financial aid paperwork and learns their Expected Family Contribution, the aid package develops. The FAFSA governs Pell Grants, which are need-based government grants that don’t need to be repaid if the student graduates, as well as Federal Work-Study jobs on campus. Schools then use the remaining need to assign their own grants. The best metric of comparison here is the Average Percentage of Need Met, available on the College Board’s website¹. For example, a $60,000 private college that meets 100% of need may price out similarly to a $30,000 public university that meets 25% of need. Just as each family’s child is a unique individual, so are their prospects in the wild and wacky world of college aid!

*Some schools use CSS and exclude the non-custodial parent (e.g. Chicago, Georgia Tech, Vanderbilt in 2022-2023) see https://profile.collegeboard.org/profile/ppi/participatingInstitutions.aspx

**In 2021 this is $15,000 per recipient; spouses can split gift $30,000.

- College Board Database Search https://bigfuture.collegeboard.org/college-search