Key Takeaways:

- Economic data indicates a return to pre-pandemic levels of activity

- A tight labor market has contributed to some wage inflation

- Inflation, wages/jobs, supply chain issues will continue to be areas of interest

As kids return to school, summer trips come to an end, and everyone starts to eye the holidays, investors and analysts alike begin to again scrutinize the markets and the economy. Typically, market volatility and trading volume is low during the summer, with many people spending time with friends and family, rather than analyzing P/E ratios. As Labor Day comes and goes, the focus returns, and this year is no different. As we look forward to the end of the year and the start of 2022, we believe that the data demonstrates an economy that is recovering and is setting the stage for a fundamental recovery from the global shutdown a little over a year ago.

Today’s commentary is a bit more technical than most. However, we wanted to share several important sets of data and help explain where we see the current economic environment. We continually monitor this information, as it helps us navigate the markets and helps us advise clients on decisions being made within their personal financial situation. Below are several of the most important macro statistics that we continually analyze.

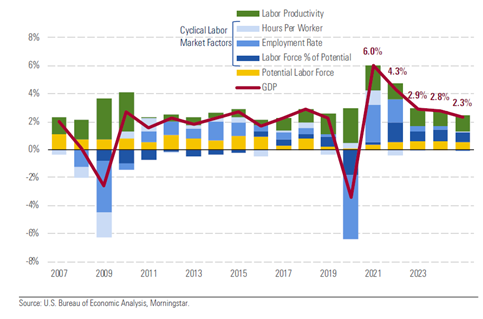

Gross Domestic Product. When we start to look toward the end of the year and upcoming years, most analysts estimate 2021 ending with GDP surpassing all years going back over a decade, followed by a strong 2022 and 2023+ returning to more “average” growth. Below is Morningstar’s[i] projected GDP growth through 2025.

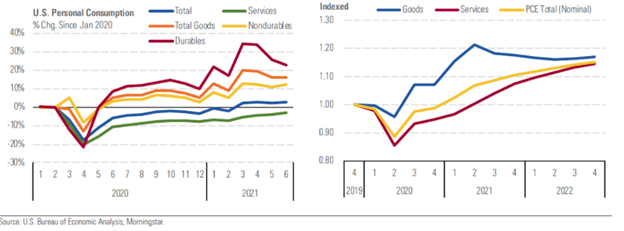

Consumer Spending. Without surprise to most, consumer services have helped fuel the most recent phase of the economic recovery, with restaurant and hotel demand now only down a modest 3%[ii] from pre-pandemic levels. Other service areas have lagged restaurants and hotels (air travel, amusement parks, etc.) likely due to risk-sensitive people still avoiding highly congested areas.

US personal consumption has increased from pre-pandemic levels but is evolving from goods-driven growth (think how many people have updated/renovated their home over the past 18 months) to services-driven growth. As more and more people return to “normal” and become busier again, it is logical to see a higher demand for services.

*Morningstar’s Projections

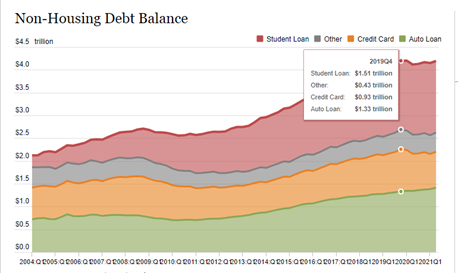

Consumer Debt. The growth that has occurred going back to the global shut down has largely occurred while keeping debt in check. Consumer debt remains near pre-pandemic levels, with credit card balances growing in Q2, ending declines over the past four consecutive quarters[iii]. This may largely be impacted by government stimulus programs, but it is still a positive for the state of the consumer. Meanwhile, aggregate loan delinquency rates have also remained low and declining from pre-pandemic levels, potentially reflecting a usage of forbearance strategies provided voluntarily by lenders and through the CARES Act.

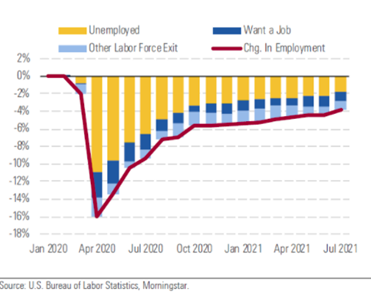

Jobs. With a better understanding of consumer spending and overall growth, one question we get all of the time is Where are all of the workers!? It is clear that there is a demand for employment. As I drove to work today, I noticed four different signs from businesses looking for employees. A common theme we hear from business owners is that they cannot find people to work. Yet, we have a 5.2% unemployment rate and job hiring is slowing, according to Morningstar. As expanded unemployment programs end this month, we expect to see jobs begin to be filled over the upcoming months.

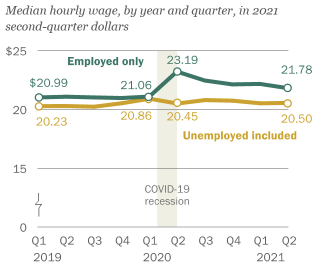

Wages. Wages have increased across the US, most notably in the retail sector where some companies have increased hourly wages by 50% or more. However, the median wage increase that promptly occurred in the spring/summer of 2020 is slowing to a more modest pace and may be showing signs of coming back down. According to Pew Research, the US median wage increased in Q2 of 2020 but has come down almost $1.50 since this peak[iv].

We could share many more statistics, but the theme is clear. The economy has experienced a fundamental return from the global shutdown. The largest question ahead is where we go from here. There will be several important hurdles to address, as is always the case in any economic environment. As we navigate the next 6-12 months, we will be paying close attention to inflation, wage growth, supply chain concerns, employment, US tax changes, US debt, etc.

As always, making good financial decisions in good markets is just as important as making good financial decisions in poor markets. Now is a great time to reevaluate your financial plan, if you have not done so lately.

SOURCES:

[i] Nagarajan, Sachin; How Close Is the U.S. Economy to Normal?; Morningstar; September 2, 2021; https://www.morningstar.com/articles/1056741/how-close-is-the-us-economy-to-normal

[ii] Bureau of Labor Statistics; News Release – The Employment Situation – August 2021; U.S. Department of Labor; September 3, 2021; https://www.bls.gov/news.release/pdf/empsit.pdf

[iii] Center for Microeconomic Data; Household Debt and Credit Report (Q2 2021); Federal Reserve Bank of New York; https://www.newyorkfed.org/microeconomics/hhdc

[iv] Kochhar, Rakesh and Jesse Bennett; Despite the pandemic, wage growth held firm for most U.S. workers, with little effect on inequality; Pew Research Center; September 7, 2021; https://www.pewresearch.org/fact-tank/2021/09/07/despite-the-pandemic-wage-growth-held-firm-for-most-u-s-workers-with-little-effect-on-inequality/