Without question, over the past year, the most common topic we have discussed with clients is inflation and rates. Whether you are in retirement, peak accumulation years, or just starting out, inflation has impacted everyone… from raised costs at the grocery store, to travel, to even attending a sporting event. Fortunately, there are increasing signs of light at the end of the tunnel.

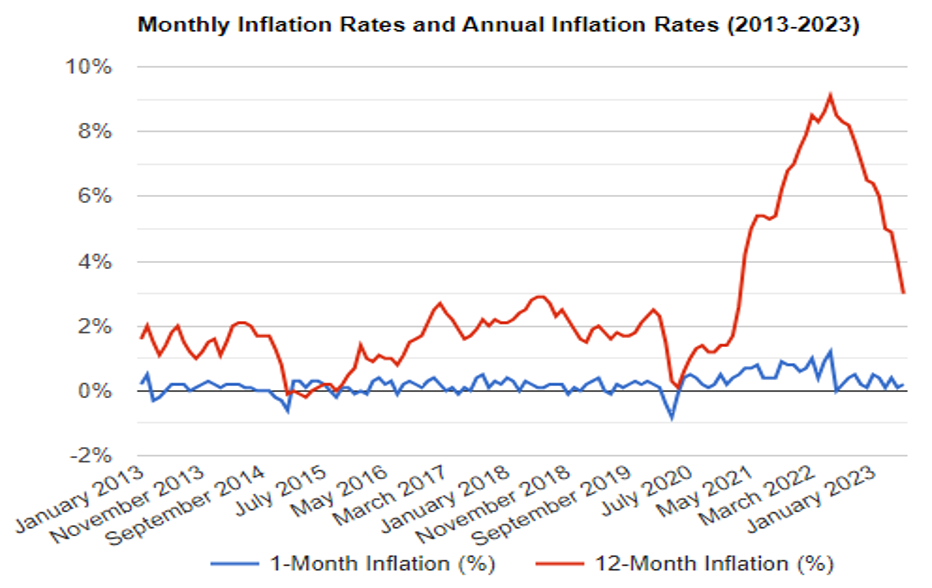

Inflation peaked nearly a year ago in June of 2022 at 9.1%, causing significant concern about runaway inflation, an environment that could quickly wreck an economy. Since this peak, the Consumer Price Index (largely the most common measure of inflation) has dropped rather precipitously to 3%, just twelve months later.

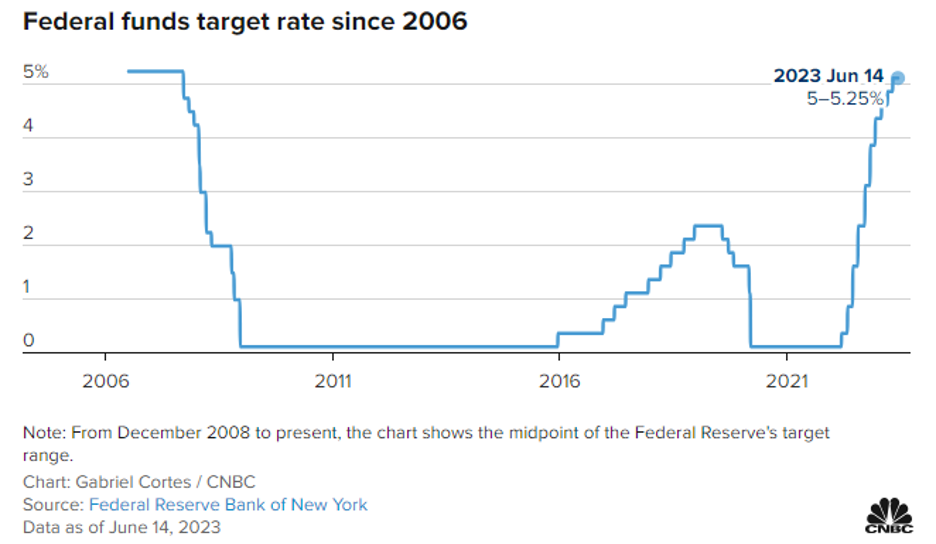

Many attribute the swift reduction in inflation to the aggressive action by the Federal Reserve to increase the Federal Funds Rate from 0% in early 2022 to an abrupt 5%+ in nearly 12 months. While it can be argued whether the Fed should have acted sooner, the rate increases, without a doubt, reduced the risk of a runaway inflationary environment.

Last month, the Fed did not increase the Federal Funds rate for the first time since they started, but they did signal two additional rate hikes coming. They are seeking to tamp down inflation back towards the 2% target.

The looming question at this point is where do we go from here?

Jeremy Siegel, Wharton School of Business Professor of Finance, well-respected economist, … and publicly recognized as a permabull, recently called our economic environment a “Goldilocks economy.” Professor Siegel references strong economic growth, falling inflation, and dropping jobless claims as an indication of stability coming back to our economy, while also urging the Federal Reserve to limit/stop raising rates.

The narrative has changed from a “raise, raise, raise” environment to a “wait and see” or potentially a “this is enough” type of environment. With the indication of another two rate hikes, we expect the Fed will be careful to increase or decrease Federal Funds rates going into the fall/holiday season, leaning heavily on upcoming economic data to support these decisions.

While the underlying economy and inflation appear to be doing better than anticipated 6-12 months ago, the uncertainty around the Federal Funds rate and borrowing costs will continue to challenge consumers. We believe that inflation has the potential to remain low going into the fall, but rates will likely not follow an immediate precipitous path back down, pending something unforeseen. This uncertainty will continue to be a challenge to the direction of the economy/market and the housing sector as borrowing costs are likely to remain high for at least the next several months.

Navigating this time will be very important, especially for borrowers and depositors. As always, please lean on us for guidance in your individual situation.