Yes, I said it; there are countless reasons to celebrate what we are and have been experiencing in the financial markets. From a historical perspective, we believe the developments in this environment are constructive to a healthier economic and market environment in the future. Let me count the ways:

1. The Market is FINALLY discerning between great business and great stories.

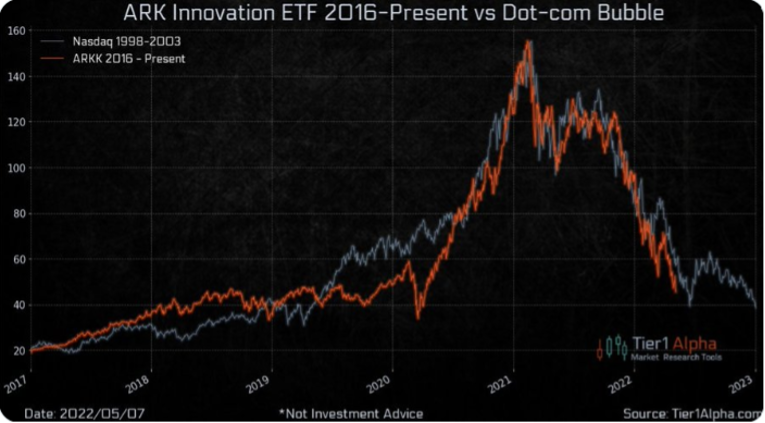

In 2000, the tech bubble imploded and although no market periods perfectly mimic another, there are several remarkable similarities between that time and now. Notice the almost lockstep overlap of the NASDAQ during the tech bubble, and the most recent (and highly celebrated) tech-centric ETF Ark Innovation (ARKK). I searched for commentaries and articles during ARKK’s peak and the comments consistently praised this “new “ strategy seeking disruptive (and mostly unprofitable) companies (example: “Cathie Wood’s Investment Philosophy is Genius” from Medium blogger David Turing in December 2020).

As of this morning, ARKK is off roughly 74% from its high in early 2021. While we never celebrate someone losing money, it is vital that markets, over the long run, apply sound reasoning in how assets are priced. Today, many companies who previously were given long runways to prove profitability are now being punished by market forces when profitability is not imminent. As investment advisors who work to apply consistent process and thought to our decision-making, we are pleased with the market (at least for now) applying some amount of rationality while also ridding the market of some amount of complacency. If markets allow complacency to build for too long, market corrections are often more severe.

2. The Fed is Raising Rates because the economy is TOO Strong.

There are certainly downsides to an economic environment like we are experiencing today. Inflation and fuel prices are high and economic growth has been somewhat more subdued than expected. However, we are also coming out of a global pandemic, and the demand for EVERYTHING is elevated: travel, homes, and cars, to name a few. Joblessness is low and available jobs are plentiful (with tons of openings going unfilled). The population is, on average, sitting on more cash, less debt, higher value portfolios, higher home values, and more income than ever.

The two scariest economic windows of the last 30 years occurred during the financial crisis in 2008-2009 and the pandemic’s onset in March of 2020. In both scenarios, unemployment spiked, banks looked and were exposed to huge capital loss, and the risk of a depression was real. We all need to put this environment in perspective; even if we experience a recession (two negative GDP quarters), it is predicted by many economists and us to be mild. There is such a negative connotation with the word “Recession” but any long-term investor has to accept the fact that recessions are inevitable and often part of a full business cycle.

3. The “training wheels” of artificially low-interest rates appear to be coming off.

Many news sources (Financial and Non) have been focusing their efforts on stories about higher inflation and the Fed’s reaction. When the Fed reverses course from decreasing to raising (or vice versa), market volatility ensues primarily because of the uncertainty of the new economic backdrop. The chart below reflects the Fed Funds rate over the last 25 years. Notice all decreasing rate environments were in reaction to terrible economic conditions: Post 9/11 and tech bubble recession in 2001, the Financial Crisis in 2008, and the pandemic in 2020.

The Fed is assuredly trying to stymie inflation with this activity, but it also knows that we need to return to a rate environment that more properly prices risk. Is a 30-year mortgage under 3% properly pricing the risk to the lender? Is being paid .005% on a savings account fair to a saver? Of course not. For over thirteen years, rates have been maintained artificially low. For our long-term economic health, we should all be hoping that rates normalize and that the current economy can digest the change along the way.

This market (as is the case with most down markets) tends to refocus investors’ attention on very short-term outcomes. We believe our job is to refocus people on their long-term objectives knowing that emotional and short-term decision-making often proves counterproductive. This would be a great time to implement a planning strategy (i.e. Roth conversion) and we also suggest retesting your plan at these market levels and potentially higher inflation projections. With a long-term perspective on your situation and the market and economic environment, we see no reason this period should negatively impact your long-term situation.

Sources:

Tier1Alpha.com, “ARK innovation vs. Tech Bubble”

TradingEconomics.com, “Fed Funds Rate, Last 25 Years”