Corporate strategies can tell opposing stories about a firm’s future

Key Takeaways:

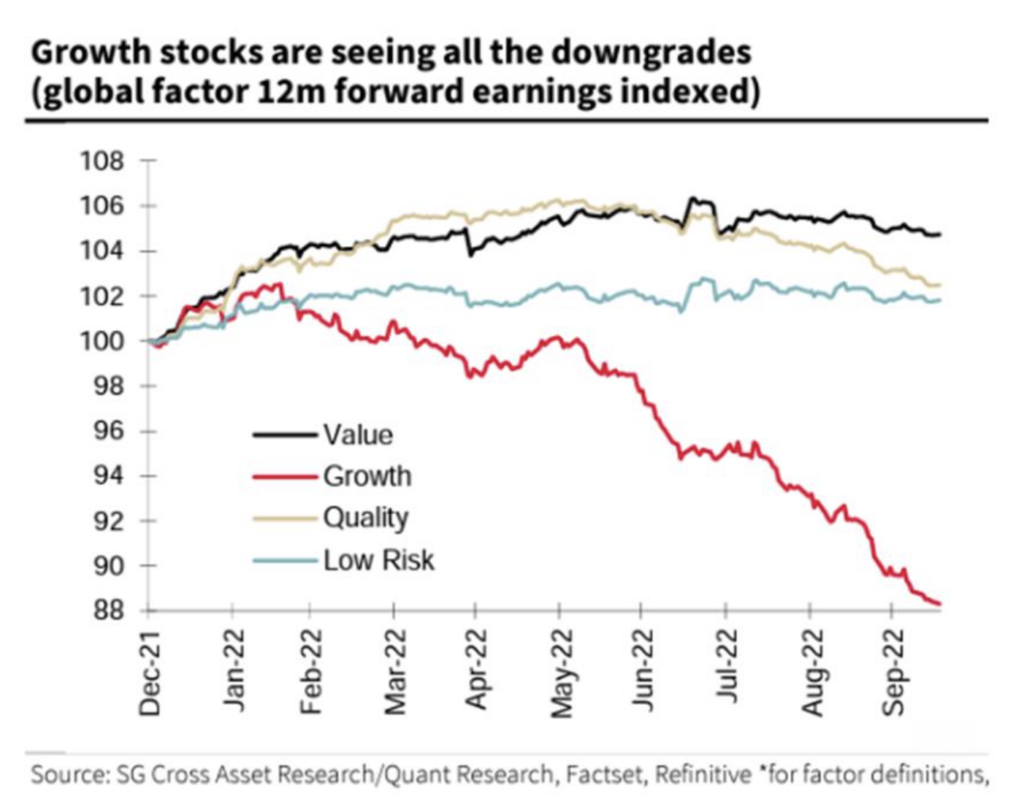

- Earnings season has seen growth companies downgraded amid rate hikes

- CEO’s actions must be weighed by investors at a firm-specific level

- Layoffs, buybacks, CapEx, debt, & dividends each contribute to firm outcomes

We are in the middle of third-quarter earnings season, the first to digest a hawkish Fed that raises rates in 0.75% increments. With a Fed Funds rate up 3% on the year and expected to peak at 4.75% next spring, the market is repricing companies with a renewed focus on fundamentals; show a speedy path to profitability or be punished. The resulting volatility highlights the conflict CEOs of publicly traded companies face. They must steer toward maximum long-term profitability while being graded by the public on a quarterly basis. Any action a listed company takes today should be questioned: is this move reflecting today’s tight money & volatile market, or is it the best strategic decision for the firm long-term? Put more simply, Trick or Treat?

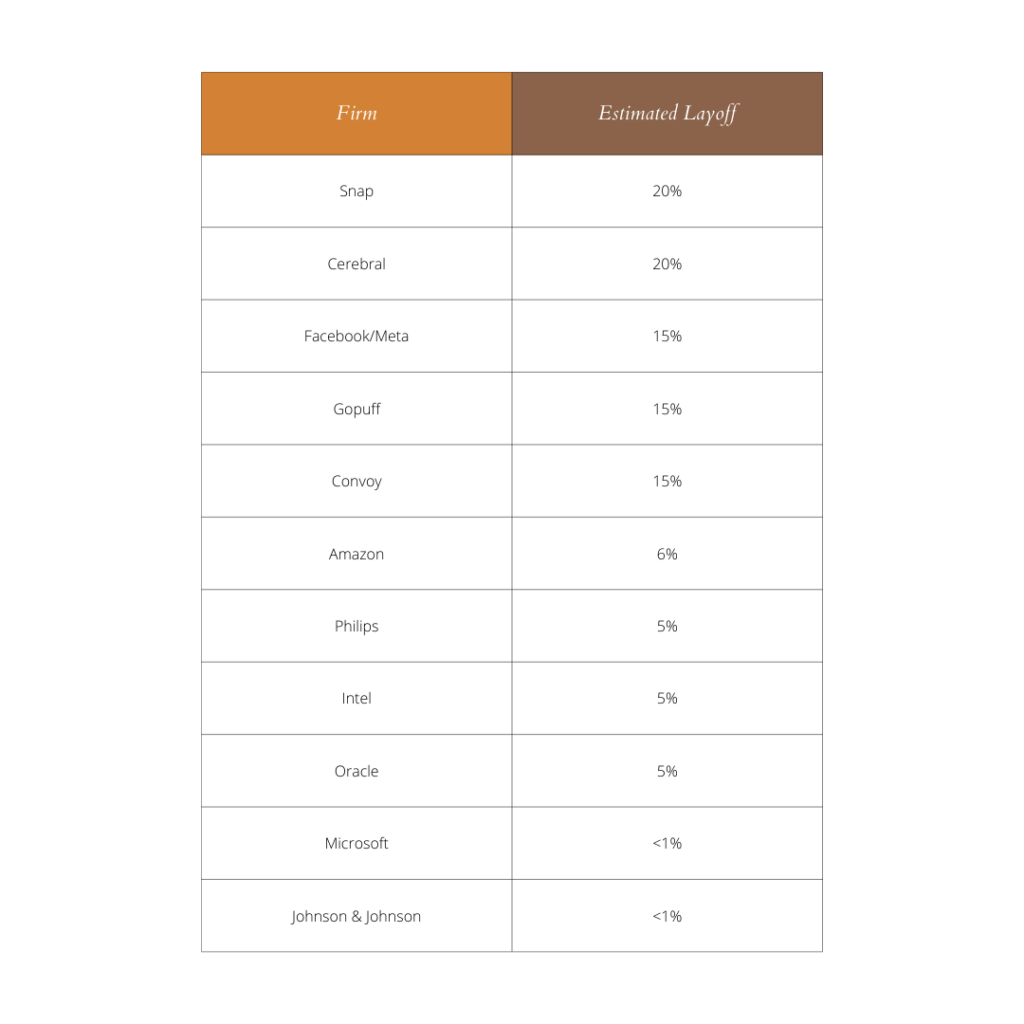

Layoffs– Cheap liquidity has disappeared and firms that may have focused more on growth than balance sheet efficiency are looking to cut expenses in the payroll category. The results tell an interesting story in a non-scientific survey (Google search 10/25) of corporate layoffs. Layoffs are concentrated among growth/technology firms, with younger firms yet to show profitability (SNAP) culling much more of their workforce than more mature & profitable firms (MSFT, JNJ). It is certainly easier to tell a story about strategic restructuring for the bottom half of the list compared to the top half where cuts are heavier and more indicative of a severe change in focus, if not outright financial distress.

This is by no means an exhaustive recording of layoffs, many of which are never announced publicly. Nonetheless, it is a fitting snapshot of a market where growth stocks, led by technology & consumer discretionary sectors, are experiencing the majority of earnings downgrades.

Layoffs are not the only action taken by CEOs that should be questioned. A handful of others can provide a Rorschach test for investors hoping to determine a company’s future.

Stock Buybacks: When a firm buys back its own stock, they often say that it is the best possible investment available to its leadership. However, retiring stock also boosts ratios like P/E & ROE, moving the stock closer to a coveted “buy” rating.

Capital Expenditures: CapEx represents the funds used towards items that sit on a firm’s balance sheet. Increasing this investment can be a sign that a company is poised for future growth with a pipeline of new projects, but CapEx is also increased by firms that must spend more to maintain aging facilities & machinery.

Debt Issuance: Firms are just like households in that they can have good and bad debt. Companies that use debt as a crutch to double down on unprofitable business lines & bloated payrolls are like consumers that are too reliant on credit cards. Responsible firms that finance expansions into new markets or new technologies are like homeowners who build wealth with a reasonable mortgage.

Dividends: To many investors focused on value and fundamentals, dividend history is the ultimate acid test of a company. A dividend cut casts a long shadow, especially for a company with a consistent record of strong dividends. However, holding back profits can be a positive capital allocation decision, such as an acquisition that can expand future profits. Just like with any of these actions taken by CEOs, investors must dig into an individual firm’s fact pattern to make the determination of Trick or Treat.