One of my favorite television shows is Shark Tank, which shows aspiring entrepreneurs pitching their business plans to seasoned investors, the “sharks,” in hopes of an investment. The sharks use their own money to invest, so they ask tough questions to help evaluate the business’s potential. Have they demonstrated sales? How much does it cost to acquire a customer? Do they have patent protection? If an entrepreneur doesn’t know their numbers, the sharks’ reactions can be insulting and even cruel. Imagine, in this high-pressure environment, if one of those entrepreneurs entered and asked the sharks for half a million dollars. “What makes you worthy of our investment,” the sharks would ask, and they would receive a reply: “I graduated from high school!”

Welcome to the world of student loans! It’s as far as you can get from Shark Tank. An 18-year-old without much more than a high school diploma and a pulse can be approved for six figures of loans without any consideration of their ability to repay. And this isn’t the world today’s parents remember. In 1975, the average cost of attendance for an in-state school¹ was $1,683 and minimum wage² was $2.10. You could pay for school working 16 hours a week (with two weeks vacation!). In 2017, the same calculation³ requires 55 hours of work per week. It is simply not feasible for most students today to work their way through school. Therefore, it’s crucial that today’s students are educated about student loans.

- Student Debt is Forever: Students should plan on paying back every loan they take out. There are very limited instances of true student loan forgiveness, such as Public Service Loan Forgiveness and Teacher Loan Forgiveness. However, each limits employment flexibility, so there’s no “free lunch.” Student loans are not automatically discharged in bankruptcy. Generally, the only sure way to get out of student debt is to die.

- Federal Loan Servicers Don’t Care About You: Just like their peers that operate the phones at Social Security, loan servicers tend to know the rules not much more. They do not provide advice or try to help you optimize your situation. They’ll be happy to suggest an income-driven payment plan that will help you live beyond your means for 20 years and stick you with a six-figure tax bill immediately afterward. The student needs to take ownership of researching their options and choosing the one that helps maximize their financial wellbeing over their lifetime.

- The Best Offense is Good Defense: Avoiding taking out more student loans is the best way to ensure you don’t have a larger student loan balance (sometimes we need to state the obvious!). School choice plays a large part here, and there are volumes of articles about school value available. The insidious cause of extra loans is poor scheduling while in college. Schools see warm bodies in the advising department as a great cost-cutting opportunity, and it’s very easy for students add years to their tenure through poor scheduling. Once again, the student needs to be responsible for their own fate, mapping out their progress through their chosen major and making sure they knock out prerequisite coursework and begin major-specific electives on time. This is a rare opportunity to get something for free! Most schools don’t charge more to take 21 hours than 15 hours and getting ahead of peers as a freshman often results in better preference in scheduling for remaining semesters.

- Debt Reduces Flexibility: This is a truism about debt of any type. Any time someone takes on an obligation, they have less flexibility to take risk. This means students with large loan balances are less likely to start businesses and are more likely to sacrifice growth potential for guaranteed salary. Thus, the cost of student debt isn’t only the loan balance, but also the opportunity cost of being risk-averse in a fledgling career.

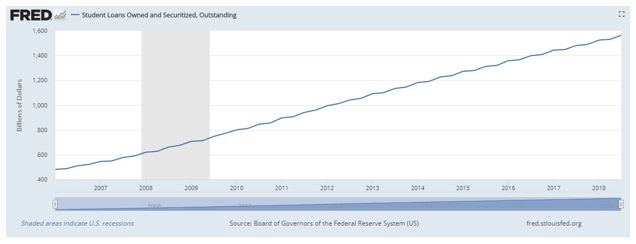

- You Are Not Alone: This discussion may seem like a warning, but it should also be viewed as an opportunity. College students all over the country face the same challenges. As is plainly clear below, student loans are earning a spot alongside death and taxes as the only guarantees in America. However, the college graduate who has worked to minimize their debt load, is willing to delay gratification to pay down debt, and who has increased their earning ability through their coursework will be light-years ahead of their peers.

- American Association of State Colleges & Universities https://files.eric.ed.gov/fulltext/ED119552.pdf

- Minimum Wage https://www.dol.gov/whd/minwage/chart.htm

- College Board 2018 College Costs https://trends.collegeboard.org/college-pricing/figures-tables/average-published-undergraduate-charges-sector-2018-19