Will your child wow you with a 4.0 GPA in high school or do they believe C’s get degrees? Are their sights set on private colleges in expensive cities or the public university up the road? Do they know their path, or will they meander through three majors over six years? If you know the answers to these questions at birth, we can tell you with great certainty how much you’ll need to save for college tuition. For those without a crystal ball, college savings is one of the most confounding questions in planning. Let’s discuss how we think about college savings with parents of future scholars- from newborns to rising seniors.

How Much Does It Cost?

We discussed the large difference between a schools advertised “sticker price” and the amount any given student ends up paying in our most recent discussion. Nonetheless it helps to have a number on which to set our sights. US News¹ compiled average costs for 2018. In-state public tuition and fees averaged $9,716, out-of-state public averaged $21,629, and private averaged $35,676. That’s just the price to attend class and put gas in the Bunsen burners; room and board is roughly $10,000-$15,000 per school today. Altogether that puts the cost of attendance anywhere from $80,000-$250,000 for four years of tuition.

That’s a Big Range of Big Numbers!

Yes, that range is downright intimidating and it usually only serves to dishearten and paralyze parents. Our advice to combat this uncertainty is simple: every bit helps. Regardless of how and where you save, putting some amount away monthly or annually will take the bite out of college costs. Even if you’re not projected to fully fund college by age 18, every dollar saved counts double. First, that saved dollar is available for tuition payments. Second, having the discipline to live on one dollar less frees up that cash in the future for other goals, including helping with tuition payments if needed. Plus, those dollars saved may appreciate if invested.

How Much Should We Save?

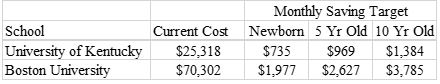

How much to save is the question we hear most often, and it requires several assumptions. College tuition has inflated at nearly 7% over the past decade, meaning you could invest savings and still lose ground. We hope for parents that this trend does not sustain itself, but as with all topics we like to think conservatively and hope to be surprised positively. The table below shows what parents would need to save monthly today if tuition inflates at 7% and savings earn 8% over time. As you can see, regardless of the school’s current cost or tuition inflation, it pays to begin saving early.

In our experience, the vast majority of parents do not fully fund college for their children with savings that begin at birth. Many parents start saving later or set their goal to provide tuition only. Others like the idea of making comfortable contributions today and diverting the dollars the already spend on their children (travel soccer, anyone?) to help when the time comes. Still others see a value in the child taking on some portion of the expense. Simply put, there is no one-size-fits-all solution when it comes to saving for college. Our hope for those we work with is to think about it sooner rather than later and make a plan that works well for them.

Source:

- https://www.usnews.com/education/best-colleges/paying-for-college/articles/paying-for-college-infographic

- Table is Original work with current Cost of Attendance from Collegedata.com