Key Takeaways

- The IRS made a retiree-friendly tweak to its RMD schedule for 2022

- When to best take retirement distributions can be opposite for two similar investors

- Engage Us: We do our best work when we know your updated situation

We’re only a week into 2022 and I have already spent a few hours deep in spreadsheets getting excited about financial planning. If you are 72 years or older, or have inherited retirement accounts, you are likely aware of Required Minimum Distributions (RMD’s). In exchange for extremely beneficial tax deferral on retirement accounts, the IRS mandates a portion you must distribute from your retirement account, and pay tax on, annually. We begin 2022 with a new schedule for RMDs; the IRS has tweaked these annual percentages in a way we believe benefits retirees. Anytime the rules change we rethink our playbook to ensure we are not missing any planning opportunities. Today we’ll review how we have responded to recent reform and outline some RMD strategies we are using with clients.

Donations from IRAs

We have written multiple times about Qualified Charitable Distributions, donations from IRAs by people who are age 70 ½ or older. This strategy became more prevalent following the 2017 tax reform. If you do not itemize deductions on your tax return, we encourage you to consider this strategy prior to taking your 2022 RMD.

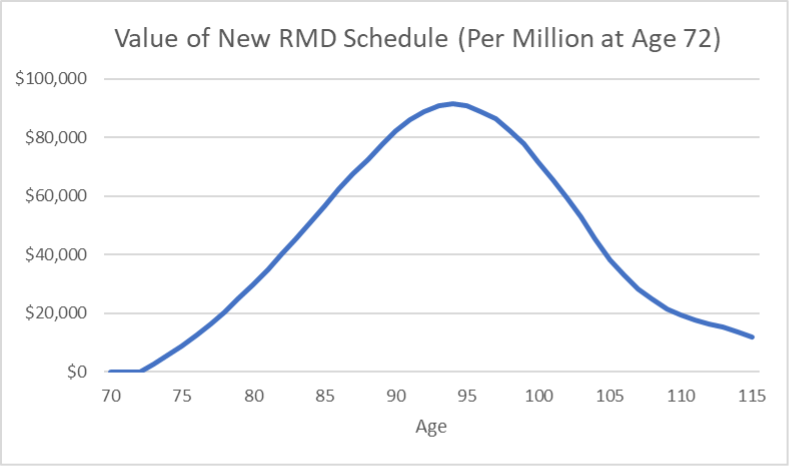

New RMD Schedule in 2022

The IRS has finally updated their RMD schedule¹ to match the delay from age 70 ½ to age 72 that was enacted by the SECURE Act in 2019. For any given age, the amount that must be distributed from a retirement account is decreased. More importantly, this amount ticks up more slowly in early retirement. There is no action needed on your part to benefit from this change. I highlight it because it shows that the IRS realizes the need to weigh reform to be easiest on our least flexible population: retirees.

Elimination of Stretch IRAs for Non-Spouses

While we believe reform tends to be friendly to current retirees, we believe the opposite is the case when it comes to transferring wealth to the next generation. This was proven when the 2019 SECURE Act mandated that your children must distribute inherited IRAs over ten years. This tweak reinforced our long-time belief in the benefits of Roth investing, as pre-tax retirement dollars now become less desirable to inherit, and we adjusted our playbook accordingly.

How & When Should You Take Your RMD

Our understanding of these various reforms has shaped how we guide our clients to optimize their RMDs into a three-step process:

- Donation or Donation Set-Aside: If there is any chance you may donate some of your RMD, we want you to maintain your flexibility to do so. We only see a tax benefit if your IRA donation is made prior to distributing the rest of your RMD.

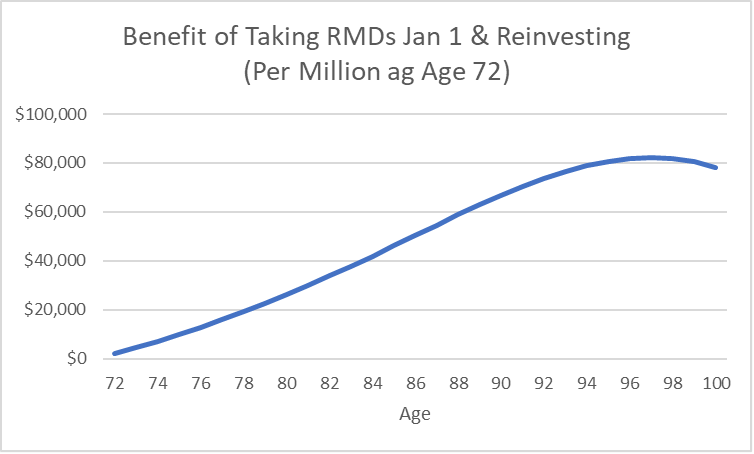

- No Income Need: If you are in the minority of retirement investors who do not rely on their RMD for annual spending, our goal is to distribute your RMD at a market low. This is because the RMD is a fixed amount determined at the first of the year and distributing that amount at a low point lets you distribute proportionally more of your total IRA balance. Since you are not leaning on your IRA for income, our goal now is to minimize the tax paid to distribute the funds.

Unfortunately, we never know when a market low will happen. However, we have the entire history of the US Stock Market indicating that markets generally rise over time. Thus, it makes sense that on average the first day of the year is the market low point. I made a chart below illustrating the benefit of taking RMDs at the beginning of the year².

While we know we cannot predict a market low, at times it will become clear that we are closer to a relative low, such as in the spring of 2020. In those times, we can utilize Roth conversions to accelerate the distribution of your IRA account with a relatively friendly tax burden.

- Behavioral Finance: If you are in the majority of retirement investors for whom IRA distributions comprise the bulk of their income, we seek out the best distribution schedule to match your financial personality. The inverse of step two holds true: if we want to maximize the longevity of your retirement account, we would keep the dollars invested as long as possible. However, the predictability of your income is more important than maximizing the return on every dollar in your account. Back to spring 2020 for example, if one was fully invested in stocks and needed income, they were forced to sell at a market low. For this reason, we sacrifice some return to maintain some liquidity in cash and a less risky stance in bonds for investors who are taking regular income. Over time this proves optimal as it avoids selling low and increases our probability of sticking to our investment plan.

Clearly, when we think about structuring income from a retirement plan, there is not a one-size-fits-all solution. Nonetheless, we are confident we can pinpoint the best course of action for our clients if presented with the relevant data. Thus, if any piece of the puzzle changes, such as earned income, monthly budget, lump-sum spending, inheritance, retirement date, etc., please engage us so we can help you make the best decision for you and your family.

SOURCES:

- Federal Register Vol 85, No 219 (Uniform Lifetime Table p.72478, p.669 of pdf) https://www.govinfo.gov/content/pkg/FR-2020-11-12/pdf/FR-2020-11-12.pdf

- Assumptions: 6% annual net return, $1MM balance at age 72, distributions are reinvested in same portfolio in a taxable account. Benefit in this chart is the increase in the end balance of this taxable account which will receive the step-up in basis. Actual benefit would be larger due to embedded tax liability of the IRA, but was ignored due to variance in tax rates.