Join us for a live discussion about Roth savings on January 27th, 2022 at 4 PM on ballastplan.com/live. Our advisors will be discussing this article and answering any questions.

One of the biggest mistakes a retirement investor can make is to believe the common wisdom that Roth savings are only for low income-earners. Yes, young savers starting their careers were the target demographic when Roth IRAs were legislated into existence in 1997. But in the decades since, Roth opportunities have been expanded to the point that nearly every household can benefit from Roth investing.

We believe that nearly every household can benefit from using Roth money in their financial plan. We’ve come to this conclusion through our work with families across a wide spectrum of ages, incomes, and progress in their financial lives. In fact, the 1%, who are often advised not to bother with Roth, can be some of the biggest beneficiaries. This massive planning opportunity is missed by investors who place too much focus on seeking out tax deductions to minimize their tax bill each year. Every rule of thumb has some truth; less tax today is desirable. However, seeking out deductions without considering long-term planning is a mistake.

TYPICAL ROTH ADVICE

- Roth is for low-income earners

- High earners should maximize tax deductions

BALLAST PERSPECTIVE

- Almost every household can find a way to utilize Roth

- High earners should minimize lifetimes tax payments

Fortunately for our clients, we are fiduciaries that must advise in their best interests. In our minds, that means digging into the long-term effects of our recommendations and choosing what we would choose for our own families. This means we can’t just seek the lowest tax bill every tax year; we must seek to minimize tax payments over a lifetime and even across generations. To optimize, we must do the more cumbersome work of thinking through your cash flow five to fifty years from now and working backward to compare the effect of changes we can make today. When we do this, we consistently see that individuals and families who utilize Roth benefit in three ways: improving their finances behaviorally, increasing flexibility, and providing protection from future risks.

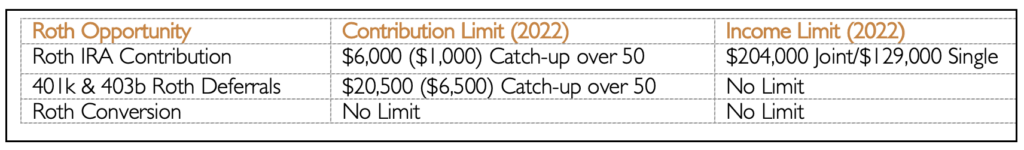

Before we get into the hard data that has convinced us that Roth is incredibly beneficial, we need to make sure we’re on the same page about what Roth is. Roth is a tax treatment; it’s not a type of account. Roth dollars are simply those upon which you have already paid income tax, are tax-deferred while invested, and are tax-free when withdrawn in the future¹. The most known source of Roth savings is the Roth IRA, which has an income limit on contributions. However, most company retirement plans offer Roth savings options that don’t limit filers based on income. A third opportunity to utilize Roth is available with the conversion of pre-tax dollars, inside retirement plans or IRAs. Under current law, there is no income limit to make Roth conversions and no limit on the size of the conversion.

Thus, Roth is available to anyone who either has earned income or has previously saved for retirement. Let’s review the three benefits Roth adds to a financial plan: improved behavioral finance, flexibility, and protection.

Behavioral Finance Benefit

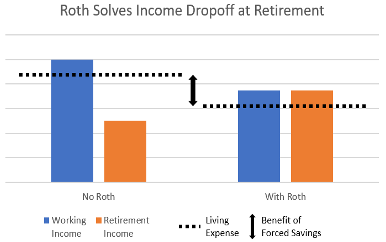

The hard math favors Roth investing; even in the top tax bracket, Roth wins over a normal investing lifetime. Even if the long-term gains were smaller,there would still be a fantastic case to utilize Roth for the behavioral benefits alone. Every savvy investor knows the power of automating savings to take advantage of compound interest. From a lifetime planning perspective, Roth investing is normal retirement savings plus automated savings for future taxes. Layering these future tax savings onto your retirement savings has a double benefit. That extra saving teaches you to live on less today, passively but effectively training you to live on a smaller budget. In turn, the amount of income you need in retirement is less, meaning you need fewer savings to reach your goal. This elegant tradeoff solves the most common equilibrium problem for most high-income households; they have an incredible discrepancy between working income and the ability to generate income in retirement.

Roth also has a final behavioral benefit. Investors who maximize retirement contributions in Roth get more purchasing power in retirement. Since retirement deferrals have fixed dollar limits (employees max out 401k savings at $20,500 in 2022), the Roth saver packs more purchasing power within that limit. Imagine two savers who maximize contributions and have the same investment performance; balances are equal, but the Roth saver has a tax-free nest egg, and the pretax saver pays tax on all distributions.

Flexibility Benefit

Ten years ago, financial planning commonly produced a thick, spiral-bound roadmap for the next thirty years. If you imagine how your financial life has changed since ten and twenty years ago, it becomes clear that those plans were doomed. Instead of focusing on the minutiae of cash flows decades out, true financial advocates should be searching for ways to create flexibility for the families they serve.

Roth investing is a fantastic way to add flexibility to a plan. Investors must consider long-term tax planning when they structure income to achieve optimal outcomes. Roth adds an extra tax bucket to choose from to optimize cash flow. When we add Roth savings to your Pre-Tax and Taxable buckets, we create tax diversification to complement your portfolio’s asset diversification. If all goes well, you can defer Roth dollars as long as possible until they become fantastic legacy assets.

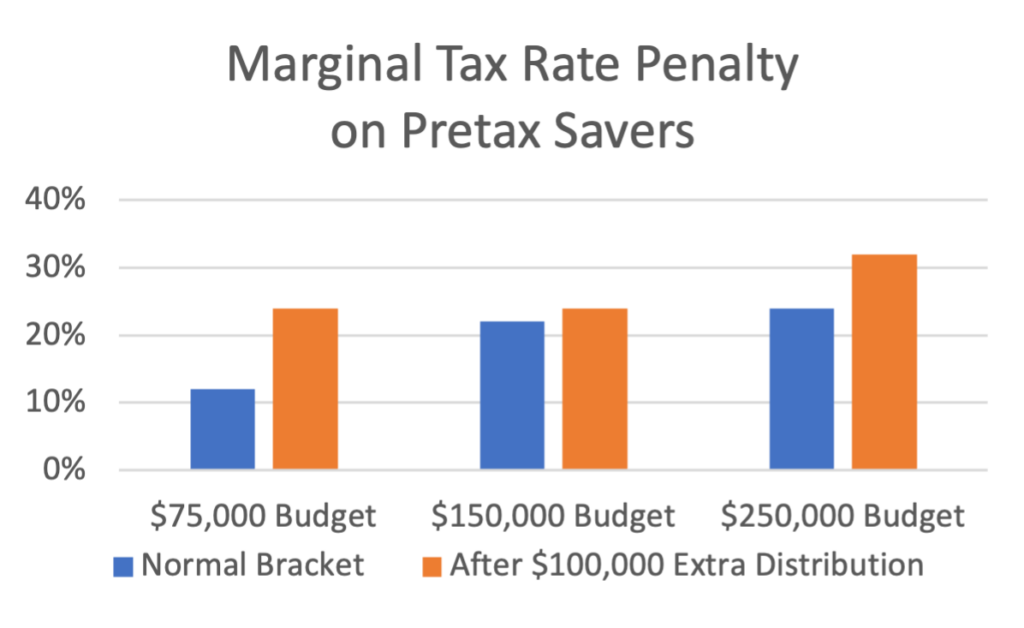

While Roth funds are fantastic long-term assets, they can also provide a great source of liquidity for an unexpected expense. Basis can be accessed prior to retirement age, and during retirement lump sums can be withdrawn without worrying about bumping up into a higher tax bracket. Imagine an investor who neglected Roth savings and only used pretax/traditional contributions, who then wants to make a $100,000 down payment on a vacation home in retirement. They may have banked on benefitting from pretax savings by retiring into a lower tax bracket, but this unforeseen expense throws a wrench into the plan; the penalty is especially harsh for thrifty households.

Protection Benefit

We live in an uncertain and unpredictable world. This much was made clear last year as we simultaneously brought the real economy to a screeching halt and enjoyed double-digit stock market returns. When we consider risks that are completely outside of our control, Roth once again shines as a beacon of stability. Roth savings provide great protection against future reform.

As a tax-free income bucket, Roth savings are immune to the risk of increased taxes. Tax rates for top and middle-income earners are about as favorable as they’ve been since the Great Depression. While no one can predict when and how tax rates will change, it stands to reason that against a backdrop of expanding entitlement spending on an aging population, tax rates are more likely to rise than fall from here. The benefit that we model using Roth funds today will only expand with increased taxes. More importantly, the risk of over-reliance on pretax retirement funds, ever-worsening as taxes rise, is eliminated.

Outside of the existential threat of rising income taxes, Roth has already provided some protection against reform. When the SECURE Act passed in late 2019, the popular stretch IRA rules that allowed beneficiaries to distribute inherited IRAs over their life expectancy was eliminated for all but spouses and a handful of exceptions. As our national debt rises and Congress searches for ways to accelerate tax revenue, Roth savers can breathe easily.

What Can Roth Do for You?

The behavioral, flexibility, and protective benefits of Roth are so powerful that nearly every family should be seeking out creative ways to utilize Roth savings. Contrary to the myth believed by many investors we’ve met, Roth strategies are available for nearly every adult in America, from newcomers to the workforce to the 1% most wealthy. We encourage you to consider how utilizing Roth might benefit you and your family. If you’d like our help, contact us at info@ballastplan.com or (859) 226-0625.

Ballast, Inc. is a registered investment adviser with the SEC. Registration with the SEC does not indicate that the adviser has achieved a particular level of skill or ability, nor is it an endorsement by the SEC. All investment strategies have the potential for profit and loss. Ballast, Inc. is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation.

Notes

- If taken after age 59.5 with some exceptions https://www.irs.gov/help/ita/is-the-distribution-from-my-roth-account-taxable