We’re all aware that saving for retirement is not a strong suit for many Americans. There is no end to the alarming statistics regarding our lack of preparedness for when it’s finally time to call it a day. The most recent head-scratcher I came across was a survey conducted by J.P. Morgan Asset Management and the U.S. Census Bureau, stating that over half of Americans are behind on their retirement savings¹. In addition, according to the Federal Reserve’s Economic “Well-Being of U.S. Households in 2023” report, 66% of Americans either believe their retirement savings are off track or aren’t sure (4).

Although we may not know exactly how much we need to save for retirement, we can all agree that we should start saving something as early as possible in our careers. There are many reasons (even some that we invent) why we don’t save more of our paychecks, but I think the one that carries more weight than just a lack of self-control is referred to as “scarcity of attention.” In an article for CNN Money, Harvard economics professor Sendhil Mullainathan states, “If you have urgent current expenses to cover, then future priorities like college and retirement fall off your radar because they are simply less pressing…Scarcity of attention prevents us from seeing what’s really important.” ²

Overcoming psychological barriers can be very challenging, and saving money now for your future self is no different, but here are a few of the lesser-known reasons why it is so important:

- Living on Less Trains your Brain for Retirement – spending less and saving more today will teach you to need less in your retirement years. Learning to live on less now also decreases the amount of money you actually need to save. According to Dartmouth economics professor, Jonathan Skinner, “people with a 15% savings rate needed 34% less money in retirement than people with a 2.5% savings rate.” ³

- Discovering and Trimming the Fat – other than simply making more money, not wasting money may be the quickest and easiest way to increase your savings. Almost all of us waste money on things we don’t need. Creating and adhering to a budget allows us to clean up these areas of waste and to save more, without necessarily putting a dent in our standard of living.

- Ability to Pursue Opportunities – saving early may allow you to jump on opportunities that you otherwise wouldn’t be able to when living paycheck to paycheck. Things like changing careers, furthering your education, or a great investment opportunity are likely to require some amount of liquidity and flexibility in your budget.

- Less Stress and More Security – the #1 priority for many people I talk to is having the financial security and resources to withstand any number of life’s setbacks. Saving early and living below your means allows you to build an adequate emergency fund giving you confidence that you can weather any storm.

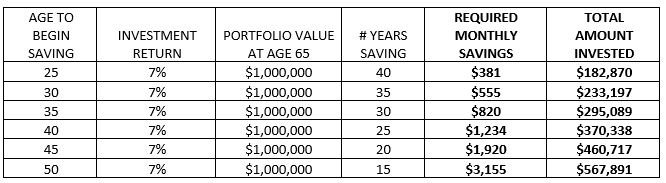

Let’s look at an example illustrating the importance of saving and investing money early in your working career. The table below depicts six different savings scenarios all based on the same goal of accruing $1 million by age sixty-five, while earning a 7% annualized return throughout the savings period.

By saving early in your career, you can enjoy the full benefit of compounding returns and save far less overall than someone who starts saving later in life. This is not to say that foregoing early retirement savings is a death sentence, rather to stress how difficult it can be trying to catch up, particularly the longer you wait. We stress with our clients, particularly our younger households, the importance of saving for retirement now. Even if it is a small amount, your future self will be so thankful!

Want to receive these commentaries directly in your inbox? Sign up for weekly newsletters, written by our advisors, here.

Sources:

- http://time.com/money/4258451/retirement-savings-survey/

- http://time.com/money/671/why-is-saving-money-so-hard/

- http://www.nber.org/papers/w12981.pdf

- https://smartasset.com/retirement/average-retirement-savings-are-you-normal

Article written in 2021, updated 2025.